Financial crime continues to challenge banks, fintech firms, marketplaces, and regulated platforms across the globe. Criminal networks adapt quickly, exploit digital channels, and move funds across borders within seconds. Regulators respond with stricter Anti Money Laundering (AML) and Know Your Customer (KYC) obligations that demand accuracy, speed, and accountability. In this environment, automation and data-driven verification shape how organizations protect themselves and their customers. The kyc Api plays a central role in this shift by enabling real-time identity checks, risk analysis, and compliance enforcement across digital systems.

Key Takeaways

- AML and KYC rules require proactive identity verification and continuous monitoring.

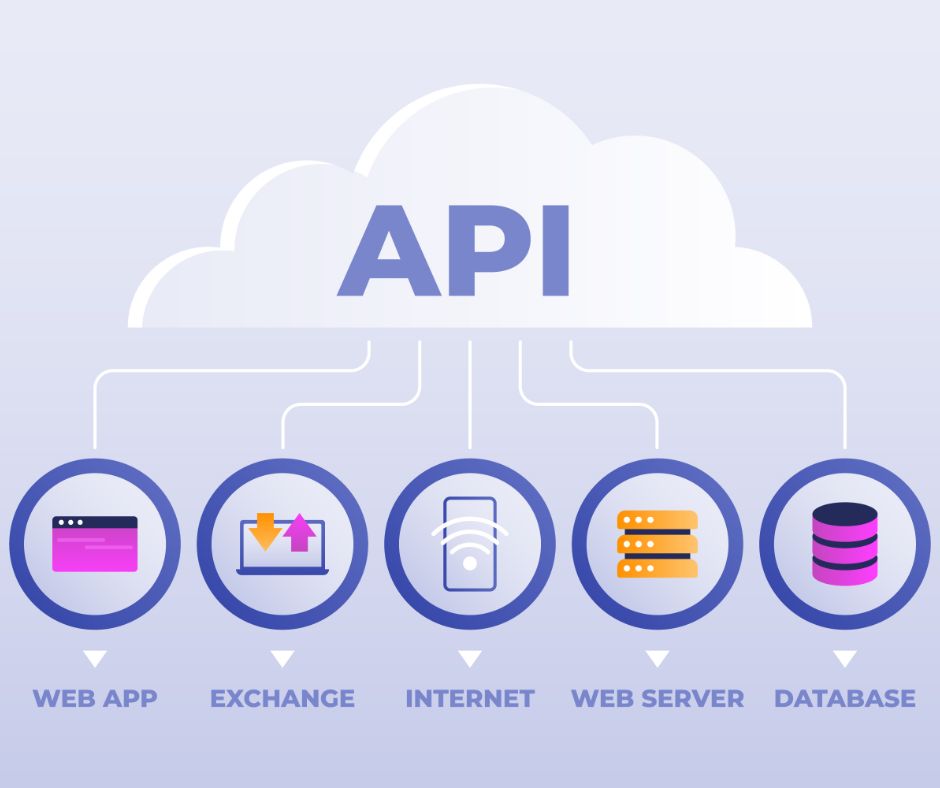

- APIs enable automated data exchange that supports faster and more consistent compliance actions.

- Risk-based checks reduce exposure to fraud and financial crime.

- Regulators expect auditable processes, traceable decisions, and secure data handling.

- Scalable verification tools help businesses grow without increasing compliance gaps.

AML and KYC: A Regulatory Imperative

Governments and financial authorities mandate AML and KYC controls to prevent money laundering, terrorism financing, and other illicit activities. These regulations require organizations to verify customer identities, assess risk profiles, monitor transactions, and report suspicious behavior.

Manual processes often fail to meet these requirements. They introduce delays, errors, and inconsistencies. Compliance teams also face high workloads, especially during onboarding surges or regulatory audits. Automated solutions address these pain points by enforcing consistent checks and reducing reliance on human judgment alone.

AML programs focus on transaction monitoring and behavior analysis, while KYC procedures validate who the customer is and whether that identity poses a risk. Both functions work together. Weak identity checks undermine transaction monitoring, and poor monitoring leaves verified identities open to misuse.

Why APIs Matter in Compliance Operations

APIs allow systems to communicate directly and securely. In compliance workflows, APIs connect onboarding platforms, databases, government registries, and risk engines without manual intervention. This connectivity supports instant verification and continuous updates.

When a customer submits identity details, an API sends that data to multiple sources, receives validation responses, and triggers next steps based on predefined rules. This approach enforces consistency across regions and products. It also supports scalability as transaction volumes grow.

APIs also help organizations respond quickly to regulatory changes. Teams can update rules, data sources, or scoring models centrally rather than retraining staff or rewriting entire systems. This flexibility reduces compliance risk and operational friction.

Identity Verification and Risk Assessment

Strong KYC starts with accurate identity verification. Organizations must confirm that a customer exists, owns the provided documents, and matches the submitted biometric or demographic data. APIs automate these checks by validating IDs, passports, addresses, and other credentials against trusted sources.

Beyond basic verification, risk assessment determines how closely an organization should monitor a customer. Factors such as geography, occupation, transaction behavior, and political exposure influence risk scores. Automated systems calculate these scores in real time and adjust monitoring levels accordingly.

The kyc Api supports this process by delivering structured data and standardized responses. Compliance teams gain clear signals instead of fragmented information. This clarity improves decision-making and reduces false positives that frustrate customers and staff.

Ongoing Monitoring and AML Controls

KYC does not end after onboarding. Regulators expect continuous monitoring throughout the customer lifecycle. Changes in behavior, ownership, or external risk indicators may require renewed checks or enhanced due diligence.

APIs enable ongoing monitoring by linking customer profiles with transaction screening and watchlist updates. When a customer triggers a risk threshold, the system flags the activity and alerts compliance teams. Automated alerts reduce reaction time and support timely reporting to authorities.

In AML operations, APIs also help with sanctions screening and adverse media checks. They scan global databases and news sources to identify associations with criminal activity. Automated screening ensures that organizations do not rely on outdated or incomplete data.

Data Accuracy, Security, and Auditability

Regulators place strong emphasis on data quality and traceability. Organizations must show how they verified identities, assessed risk, and responded to alerts. APIs support this requirement by logging every request, response, and decision.

Secure data handling remains critical. APIs use encryption, access controls, and authentication protocols to protect sensitive information. This protection reduces exposure to breaches and builds trust with customers and regulators alike.

Audit readiness improves when systems record consistent and time-stamped actions. Compliance teams can generate reports that demonstrate adherence to AML and KYC rules without reconstructing events manually.

Integration Across Digital Ecosystems

Modern businesses operate across multiple platforms, including mobile apps, web portals, payment gateways, and partner networks. APIs unify compliance checks across these channels. A single verification process can serve multiple products without duplication.

This integration reduces operational silos. Sales, onboarding, and compliance teams work from the same verified data set. Decisions remain aligned with policy, even as customers interact through different touchpoints.

Providers such as ClearDil support this integrated approach by offering configurable verification workflows that align with regional regulations and business models. Such solutions help organizations maintain consistency while adapting to local requirements.

Supporting Growth Without Increasing Risk

Rapid growth often introduces compliance risk. New markets, customer segments, or transaction types create unfamiliar exposure. Automated compliance tools allow businesses to expand while maintaining control.

APIs scale effortlessly. They handle increased verification volumes without proportional increases in staff. This scalability protects margins and ensures that compliance keeps pace with growth.

Risk-based approaches also prevent over-compliance. Low-risk customers move through onboarding quickly, while higher-risk profiles receive additional scrutiny. This balance improves customer experience without weakening controls.

Operational Efficiency and Cost Control

Compliance costs continue to rise due to regulatory pressure and staffing needs. Automation reduces these costs by minimizing manual reviews and rework. APIs process large data sets quickly and consistently.

Fewer errors lead to fewer remediation efforts. Teams spend more time on genuine risk cases rather than routine checks. This efficiency improves morale and strengthens the overall compliance culture.

The kyc Api contributes to this efficiency by standardizing how systems request and receive verification data. Standardization reduces integration complexity and maintenance overhead.

Regulatory Alignment and Future Readiness

Regulators increasingly expect technology-driven compliance. They recognize that manual processes cannot keep pace with digital finance. Organizations that adopt automated verification demonstrate proactive risk management.

APIs also support future regulatory changes. New data requirements or reporting formats can integrate into existing systems with minimal disruption. This adaptability reduces long-term compliance risk.

As financial crime techniques evolve, compliance tools must adapt quickly. Automated systems update data sources and detection rules faster than manual methods.

Building Trust Through Transparent Compliance

Customers value security and fairness. Transparent verification processes reassure users that organizations protect their data and operate responsibly. APIs contribute to this transparency by enabling consistent and explainable checks.

Clear communication during onboarding reduces abandonment and complaints. Customers understand why verification occurs and how it protects them. Trust strengthens relationships and supports long-term retention.

Next Steps for Compliance Teams

Organizations that prioritize automation position themselves for regulatory resilience and operational stability. Selecting the right technology partner and integrating verification into core systems creates a strong compliance foundation. Solutions from ClearDil help teams align identity verification, AML monitoring, and reporting within a unified framework that supports growth and accountability.

FAQ

What role does an API play in KYC compliance?

An API connects verification systems with data sources and internal platforms. It automates identity checks, risk scoring, and monitoring actions without manual input.

How does automation help with AML requirements?

Automation enables continuous transaction screening, real-time alerts, and consistent reporting. These capabilities reduce human error and support timely regulatory responses.

Is automated KYC accepted by regulators?

Yes. Regulators accept automated processes when organizations maintain accuracy, security, and audit trails. Many authorities encourage technology adoption to strengthen controls.

Can APIs support global compliance needs?

APIs integrate regional data sources and rule sets. This flexibility allows organizations to apply local regulations while maintaining centralized oversight.

Does automation replace compliance officers?

No. Automation supports compliance officers by handling routine checks and data processing. Human expertise remains essential for investigations, judgments, and regulatory engagement.