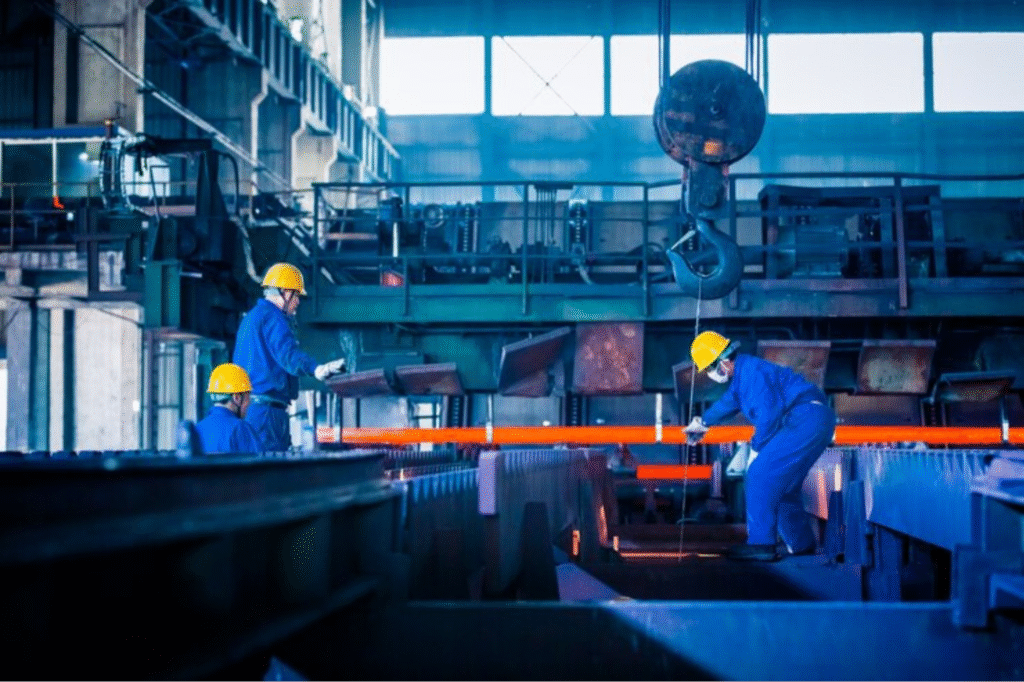

The manufacturing sector has always played a foundational role in economic growth. From producing essential goods to supporting infrastructure development, it quietly fuels progress across industries. In recent years, however, manufacturing has emerged as more than just an economic pillar—it has become a powerful avenue for long-term wealth creation, especially for investors who understand its potential.

As economies expand, urbanize, and modernize, the demand for raw materials, industrial products, and infrastructure continues to rise. This sustained demand creates long-term opportunities that extend well beyond short-term market cycles.

Why Manufacturing Matters in Wealth Creation

Manufacturing drives productivity, employment, exports, and technological advancement. Countries with strong manufacturing bases tend to show stable economic growth over time, which directly benefits investors.

For individuals looking to build wealth gradually, manufacturing-linked investments offer:

- Consistent demand across economic cycles

- Exposure to infrastructure and industrial growth

- Long-term value creation rather than speculative returns

This is one reason why investors increasingly track companies connected to industrial production and raw material supply.

The Strong Link Between Manufacturing and Equity Markets

The stock market often reflects the health of the manufacturing sector. When factories expand, production increases, and infrastructure projects accelerate, companies supplying essential inputs benefit the most.

This is where Material Stocks come into focus. These stocks represent businesses that provide raw materials such as metals, cement, chemicals, and construction inputs—resources that manufacturing simply cannot function without.

As manufacturing output grows, so does the demand for these materials, creating a strong earnings cycle for such companies.

Manufacturing Growth and Material-Based Businesses

Manufacturing doesn’t operate in isolation. It depends heavily on industries that supply:

- Steel and metals

- Cement and construction materials

- Industrial chemicals

- Energy and packaging resources

This dependency makes material-focused companies a key beneficiary of industrial expansion. Over time, businesses that efficiently supply these inputs tend to generate stable revenues and scalable profits.

Investors looking for durability in their portfolios often explore the Best Material Stocks, as these companies usually benefit from:

- Long-term government spending

- Infrastructure and housing growth

- Global supply chain demand

India’s Manufacturing Push and Investment Opportunities

India is currently undergoing a major transformation in its manufacturing ecosystem. Government initiatives, rising domestic consumption, and global supply chain shifts are strengthening the country’s industrial base.

Programs focused on infrastructure, renewable energy, housing, and industrial corridors have significantly boosted demand for raw materials. As a result, Material Stocks in India are gaining attention among long-term investors.

India’s manufacturing growth story is supported by:

- Rapid urbanization

- Increasing capital expenditure

- Export-oriented industrial policies

- A growing middle-class consumer base

All of these factors contribute to sustained demand for materials and industrial inputs.

How Manufacturing Supports Compounding Wealth

Long-term wealth is rarely built overnight. It grows through compounding—steady earnings growth reinvested over time. Manufacturing-linked companies are well-positioned for this because:

- Predictable Demand

Manufacturing relies on continuous supply, creating recurring revenue for material providers. - Scalability

As production volumes increase, margins often improve. - Inflation Protection

Many material-based companies can pass rising costs to end users. - Economic Resilience

Infrastructure and industrial projects continue even during economic slowdowns.

This makes manufacturing-related investments suitable for patient investors seeking steady growth rather than short-term speculation.

Choosing the Right Opportunities

Not all companies benefit equally from manufacturing growth. Investors should evaluate businesses based on:

- Financial strength and balance sheets

- Cost efficiency and production capacity

- Market leadership

- Exposure to domestic and global demand

When analyzed carefully, some of the Best Material Stocks can become core long-term holdings rather than short-term trades.

The Long-Term Outlook

Manufacturing is not a fading trend—it is evolving. Automation, sustainability, green energy, and advanced materials are reshaping how goods are produced. Companies that adapt to these changes are likely to remain relevant for decades.

For investors, this evolution means that Material Stocks in India are not just cyclical plays but part of a broader structural growth story tied to national development and global demand.

Final Thoughts

The manufacturing sector continues to shape economies—and investor portfolios—by creating long-term value through consistent demand and industrial expansion. As manufacturing grows, the businesses supplying essential inputs stand to benefit the most.

By understanding how manufacturing fuels wealth creation and carefully evaluating opportunities within Material Stocks, investors can position themselves to benefit from one of the most enduring growth engines of the economy.

Long-term wealth is built on strong foundations—and manufacturing remains one of the strongest foundations available.