The Reality of Cross-Border Business and Money Movement

The idea of running a business that spans borders may sound thrilling however when it comes down to money transfer, things can become messy quickly. I’ve seen businesses expand into new markets and then struggle with delays, undefined charges, and support teams who aren’t aware of how global operations function. Choosing the right bank in the beginning can save time, anxiety and lots of back-and-forth.

This isn’t about opening a new account or checking a compliance box. It’s about establishing the right financial institution that can evolve with you, adjust to changes in the market and remain assured when something happens that isn’t expected. It’s true that it’s inevitable that something unexpected happens at the right time.

Below, I’ll go over the things that businesses typically do not consider, based on how actual companies function every day, not the way brochures explain it.

Understanding How Your Company Actually Makes Funds

Before you even consider banks, you should take a step back and think about how money moves through your company right now. Some businesses process a huge number of transactions with small amounts while others handle smaller but more substantial payments. A tech company that charges monthly subscriptions operates very differently than a manufacturing firm that pays overseas suppliers.

It’s because some banks excel in handling large volumes, whereas others are focused on high-value transactions. When your flow routine isn’t in line with the strengths of your bank then friction begins to manifest in subtle but irritating ways. Manual checks, slower approvals or even sudden limits may be a sign that the systems aren’t in sync.

It’s also worth considering the frequency you transfer funds across borders and whether you prefer to keep the funds local. Many companies assume that every bank handles this effectively, however that’s not always the case in reality.

The Global Reach of the Internet Really Makes an Impact

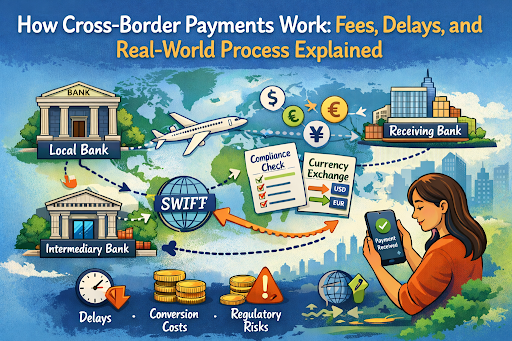

The international presence of a bank isn’t only about the number of countries they list in their site. It’s about how well connected the locations are behind the backs of the scenes. Certain institutions have robust local affiliates, whereas others depend on intermediary networks which can make things slower.

Where Global Payment Infrastructure Comes Into Play

It is here that Global payment solutions for business enter the game. Banks that have invested in these systems typically provide faster processing, more precise tracking, and less unexpected delays. It is easy to feel the difference in payments when they aren’t “stuck” somewhere without explanation.

Another thing that is often overlooked is the local exchange. The ability to receive and keep funds in a variety of currencies without the need for forced conversions can help a company save an amount over the course of time. It’s not fancy but it does add each month.

Assistance That Is Aware of the Cross-Border Realities

Support for customers is basic, but it’s among the initial signs to reveal when you expand internationally. The local bank staff may be fantastic but if they do not have expertise in foreign regulations, they will only assist in a limited way.

When Experience Matters More Than Politeness

The most reputable International payment institutions usually have teams dedicated to serve clients from across the world. These teams are knowledgeable of issues with time zones as well as compliance issues and regional banking standards. When things go wrong you shouldn’t have to create a business plan starting from scratch every time.

Another aspect to look out for is the time to respond. If your suppliers or partners are waiting for funds and you receive a long time to respond, a delay from your bank could damage relationships. Even a brief delay can feel more extended when invoices are due.

Fee Structures That Don’t Frighten You in the Future

Many banks offer low prices, but the actual cost is often hidden in the specifics. Costs for setup, conversion margins, processing charges, as well as intermediary costs can sneakily take away margins.

Asking the Right Questions Before It’s Too Late

It is helpful to ask specific questions prior to the time of your appointment. What happens if a transaction does not go through? Are there additional charges to make amendments? What are the exchange rates that are set during busy days on the market? The answers may not always be precise however, clarity beats preconceived notions every time.

Transparent pricing isn’t always the cheapest option, but it’s fine. The cost of predictable costs is easier to control than fees that can increase without prior warning. Many businesses discover this by accident, typically following the first couple of international invoices have been sent out.

The Compliance of the Law Without Constant Roadblocks

The cross-border payments are bound to have more regulations that require more checks, more documentation. A reliable banking partner understands how to deal with the process without turning each transaction into an investigation.

Balancing Efficiency With Regulation

If banks have previous experience with transactions that cross borders they are able to find a more balanced balance between efficiency and compliance. Documentation requests are easier to understand and the processes are more regular rather than responsive.

But, of course, no system is perfect. There will be times that require additional verification as well, and that’s perfectly normal. It’s important to know how well the requests are dealt with and if you feel supported instead of being blocked.

Technologies That Are Compatible With the Way You Work

Certain banks provide powerful digital tools, however only if your employees is able to use them without months of training. Dashboards, approval processes and reporting functions are supposed to be easy to use, not like a maze.

Visibility and Control Across Regions

Finance teams that are located across multiple regions can benefit from access based on role and real-time transparency. Being able to know what’s on hold as well as what’s cleared and the things that require action, helps to avoid internal confusion.

It is another instance where the second aspect of International payment partners is important. The most reliable ones are more compatible with accounting systems and provide APIs and exports that minimize the need for manual labor. The less copying and pasting you do, the more accuracy, even when you’re rushing to the closing to the end of the month.

Growth Planning Not Just for Today

It’s simple to choose the right banking system with your current financial situation however, growth can alter everything. Markets, currencies and the new requirements for compliance can strain a basic setup quite quickly.

Thinking Beyond the Current Quarter

A forward-looking partner will speak with you about what will happen in the coming year, not only this quarter. They may inquire about future expansion plans or transactions. This is usually a positive indicator, even if it seems slightly too early.

The possibility of switching banks later is there but it’s never enjoyable. Contracts as well as integrations and internal processes are entangled in financial processes. Making decisions with growth in mind, you can avoid a difficult process of transition later.

The Final Thoughts Based on Real-World Experience

Picking an international bank partner isn’t about locating the best choice, as it doesn’t exist. It’s about finding a system that works with the way your business operates, is in line with your goals and doesn’t slow your business down when there’s a lot to do.

Make sure to take the time to look over your options and ask questions that may be uncomfortable. Pay attention to the clarity with which responses are provided. Banks that communicate well during onboarding typically do exactly the same when you’re fully operational.

The end result is that financial movement shouldn’t be boring. If it doesn’t, then you’ve probably made the right choice.