Managing payroll in California can be challenging due to complex tax laws and strict labor regulations. Whether you are an employee evaluating a job offer or an employer preparing a compensation package, using a california paycheck calculator is essential for financial clarity. This tool helps calculate accurate take-home pay after federal and state deductions, ensuring transparency and compliance.

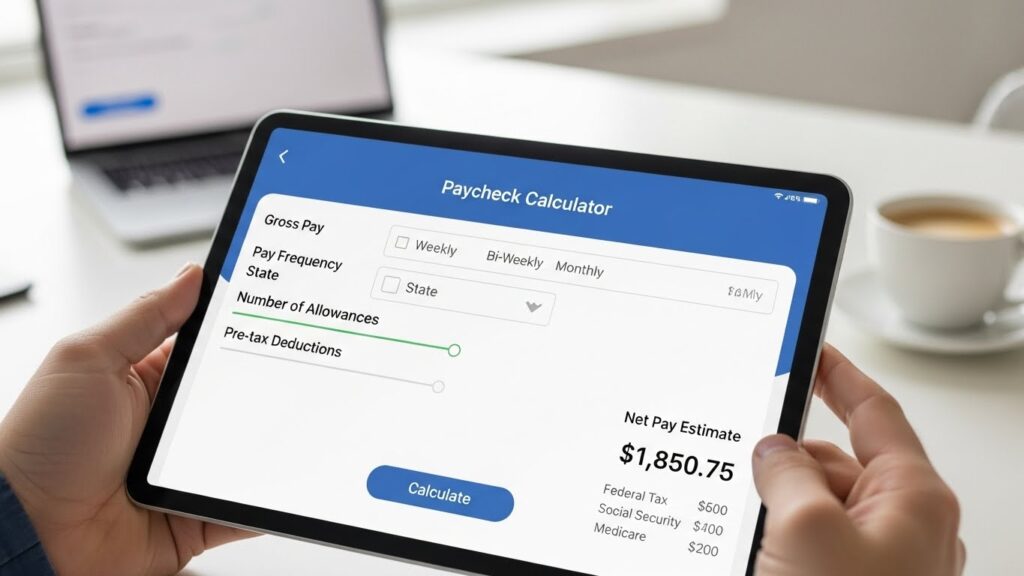

California has one of the highest state income tax rates in the United States. Because of this, estimating net income manually can be confusing. A reliable california paycheck calculator simplifies the process by automatically factoring in federal tax, California state tax, Social Security, Medicare, and other required deductions. For professionals working with an executive employment agency, understanding real earnings after taxes is critical before accepting any executive-level offer.

Why Employees Need a California Paycheck Calculator

Employees often focus on gross salary when reviewing job offers, but what truly matters is net income. A california paycheck calculator provides a detailed breakdown of deductions, helping individuals understand exactly how much money they will take home each pay period.

This is especially important for executives placed through an executive employment agency. Senior-level compensation packages may include bonuses, stock options, retirement contributions, and healthcare benefits. Using a california paycheck calculator allows professionals to compare different offers and make informed financial decisions.

Additionally, California includes State Disability Insurance (SDI) and other specific payroll deductions. Without proper calculation, employees may underestimate tax obligations. A precise paycheck calculator eliminates confusion and improves salary negotiation confidence.

Benefits for Employers and HR Teams

For businesses operating in California, payroll compliance is not optional—it’s mandatory. Mistakes in wage calculations can result in penalties and legal complications. A california paycheck calculator helps employers ensure accurate payroll processing and compliance with state laws.

Companies working with an executive employment agency often need to prepare competitive salary packages for high-level candidates. By using a california paycheck calculator, employers can clearly demonstrate net pay projections, building trust with potential hires.

Accurate calculations also help organizations manage budgets effectively. Payroll is one of the largest operational expenses, and precise forecasting reduces financial risk.

Supporting Executive Recruitment Decisions

Executive roles often come with complex compensation structures. Performance bonuses, profit sharing, relocation packages, and deferred compensation plans all affect total earnings. An executive employment agency typically assists candidates in evaluating these offers carefully.

When paired with a executive employment agency , candidates can see how different compensation elements impact their actual take-home income. This ensures realistic expectations and smoother negotiation processes between employers and executives.

The collaboration between payroll clarity and executive recruitment strategy strengthens hiring decisions. Employers present accurate financial details, while candidates make informed choices.

Financial Planning and Relocation

California is known for its higher cost of living. Housing, transportation, and healthcare expenses are often significantly higher than in other states. Before relocating, professionals should calculate expected take-home pay using a california paycheck calculator.

An executive employment agency may assist executives relocating from other states, but understanding post-tax income remains essential. Knowing net earnings helps professionals determine whether a job offer supports their lifestyle and long-term financial goals.

By estimating pay accurately, individuals can plan savings, investments, and monthly budgets more effectively.

Enhancing Transparency and Trust

Transparency builds stronger employer-employee relationships. When organizations provide clear salary breakdowns using a california paycheck calculator, it reflects professionalism and integrity.

Similarly, an executive employment agency that guides candidates through compensation analysis demonstrates expertise and commitment to long-term success. Clear financial data reduces misunderstandings and increases satisfaction on both sides.

Staying Competitive in California’s Job Market

California’s employment market is highly competitive, particularly for executive roles. Employers must offer attractive yet financially sustainable packages. A california paycheck calculator helps strike that balance by presenting realistic salary structures.

At the same time, an executive employment agency connects businesses with qualified leaders who understand the value of transparent compensation. Combining strategic recruitment with accurate payroll tools creates a powerful hiring advantage.

Conclusion

A california paycheck calculator is more than a simple payroll tool—it is a strategic resource for employees, employers, and recruiters. It ensures compliance with California’s complex tax regulations while providing clear insights into take-home income.

When used alongside the expertise of an executive employment agency, this tool supports smarter hiring decisions, better salary negotiations, and improved financial planning. In a competitive and highly regulated state like California, accurate paycheck calculation is not just helpful—it is essential for long-term success.