The Abu Dhabi real estate market is evolving rapidly, making 2026 an exciting year for investors and homebuyers alike. Whether you are looking at properties for sale in abu dhabi or planning to explore luxurious developments like mayyas at the bay, understanding the trends, opportunities, and challenges is crucial before making any purchase. The market has shown remarkable resilience in recent years, driven by government initiatives, economic diversification, and a growing interest from both domestic and international buyers. For anyone looking to buy property in Abu Dhabi this year, a strategic approach can help maximize investment returns while ensuring a smooth buying experience.

Understanding the Current Market Dynamics

The real estate sector in Abu Dhabi is influenced by several macroeconomic factors. In 2026, the market continues to benefit from a stable economy, government incentives for investors, and a focus on sustainable urban development. Residential, commercial, and mixed-use properties are witnessing varied growth rates, with luxury properties and waterfront developments attracting high-net-worth individuals.

One significant trend is the growing demand for sustainable and eco-friendly properties. Developers are increasingly incorporating smart technologies, energy-efficient designs, and green spaces to meet buyer expectations. This shift is not only appealing to environmentally conscious buyers but also contributes to higher long-term property values.

Additionally, expatriates and foreign investors remain a critical part of the Abu Dhabi property market. With policies that support foreign ownership in certain freehold areas, more international buyers are entering the market. This influx is creating healthy competition and driving premium property developments across key locations.

Key Areas to Consider for Property Investment

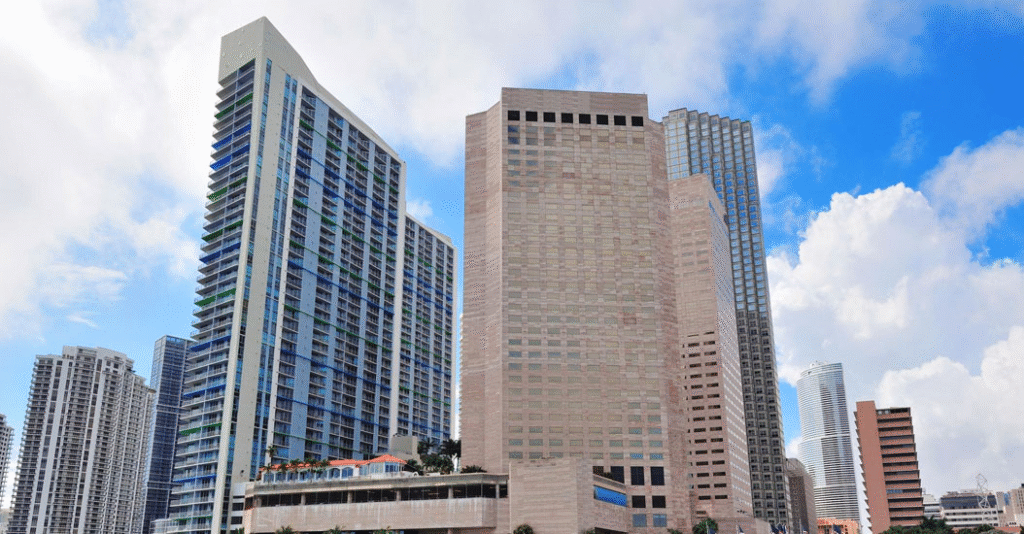

When buying properties for sale in abu dhabi, location is one of the most important factors. Prime areas often offer higher returns on investment and better long-term appreciation. Waterfront developments, high-rise apartments in central business districts, and community-focused neighborhoods are particularly popular.

- Waterfront Properties: Locations along the Corniche, Saadiyat Island, and Yas Island offer stunning views and access to recreational amenities. Properties in these areas, like mayyas at the bay, provide both lifestyle benefits and strong investment potential. Waterfront properties typically maintain higher resale values and attract tenants seeking premium rentals.

- Central Business Districts: Areas such as Al Maryah Island and Downtown Abu Dhabi have seen significant growth in office spaces and luxury apartments. These locations appeal to professionals and expatriates, making them ideal for investment in residential or mixed-use properties.

- Community-Centric Neighborhoods: Gated communities with schools, parks, and retail centers are attracting families. Buyers prioritize convenience and safety, and these neighborhoods often see steady demand for both rental and resale markets.

Market Trends Shaping Property Prices

Abu Dhabi’s property prices have been relatively stable in the past few years, but 2026 is expected to bring subtle shifts. Analysts predict moderate price increases in prime locations, while emerging areas may offer more affordable options for investors. Some of the key trends influencing property prices include:

- Economic Diversification: Abu Dhabi’s government is heavily investing in non-oil sectors such as tourism, finance, and technology. This diversification fuels demand for commercial spaces and residential properties catering to professionals.

- Expatriate Demand: A steady influx of expatriates, especially from Europe, Asia, and North America, has created consistent demand for mid to high-end properties. Areas offering international schools, healthcare facilities, and recreational amenities are particularly attractive.

- Luxury Property Boom: High-end developments, especially waterfront villas and premium apartments, continue to be a lucrative segment. Luxury properties in locations like Saadiyat and Yas Islands are seeing strong interest, both from investors and end-users seeking upscale living experiences.

- Smart City Integration: Developers are increasingly incorporating smart technologies, such as automated home systems, energy management, and integrated security. Properties offering these features often command higher prices and faster sales.

Financing Your Property Purchase

Buying property in Abu Dhabi requires careful financial planning. Mortgages and financing options are widely available, but understanding the terms, interest rates, and eligibility criteria is essential. In 2026, banks are offering competitive mortgage rates to attract both local and international buyers, making it an opportune time to secure financing.

- Mortgage Pre-Approval: Obtaining pre-approval can help buyers understand their budget, streamline the purchasing process, and demonstrate seriousness to sellers.

- Down Payment Requirements: Typically, buyers need to provide 20-25% of the property value as a down payment, though this may vary depending on nationality, property type, and bank policies.

- Interest Rates and Terms: Fixed and variable interest rate options are available, with terms ranging from 15 to 25 years. Buyers should evaluate their long-term financial plans before committing.

Navigating Legal and Regulatory Considerations

The Abu Dhabi real estate market is well-regulated, but buyers must still navigate legal procedures carefully. Understanding property ownership laws, registration processes, and fee structures is crucial to avoid complications.

- Freehold vs. Leasehold: Abu Dhabi offers both freehold and leasehold property ownership options. Freehold areas allow full ownership rights, including the ability to sell or lease, while leasehold arrangements grant property rights for a fixed period.

- Property Registration: All property transactions must be registered with the Abu Dhabi Municipality or the relevant freehold authority. This ensures legal protection and verification of ownership.

- Additional Costs: Buyers should account for registration fees, service charges, and maintenance costs when budgeting for a property purchase. These can vary depending on the type and location of the property.

Lifestyle and Amenities Driving Buyer Decisions

In 2026, lifestyle factors are increasingly influencing property decisions. Buyers are looking for more than just a roof over their heads; they are seeking communities that offer convenience, luxury, and a sense of belonging.

- Retail and Dining: Proximity to shopping malls, restaurants, and entertainment venues significantly enhances property appeal. Areas with vibrant retail hubs often see higher property appreciation.

- Healthcare and Education: Access to top-notch healthcare facilities and international schools is a critical factor for families and expatriates. Properties located near these amenities are in higher demand.

- Recreation and Green Spaces: Parks, waterfront promenades, gyms, and recreational facilities are highly valued. Developments offering comprehensive lifestyle amenities often command premium prices.

Investment Opportunities in 2026

For investors, Abu Dhabi’s property market offers several opportunities:

- Capital Appreciation: Certain areas are expected to see property value growth, especially new developments and waterfront projects. Investing early can yield significant returns over time.

- Rental Income: With steady demand from expatriates and professionals, rental yields in prime locations remain attractive. Properties in central business districts and community-focused areas are particularly lucrative.

- Off-Plan Properties: Buying off-plan allows investors to secure properties at lower prices before construction completion. Many developers offer flexible payment plans, making this a viable strategy for maximizing returns.

Spotlight on Mayyas At The Bay

Among the upcoming developments, mayyas at the bay is generating considerable interest. This waterfront project promises a mix of luxurious apartments, high-end amenities, and scenic views, making it a preferred choice for buyers seeking both lifestyle and investment value. Projects like this often benefit from strong community planning, including retail, leisure, and wellness facilities, ensuring residents enjoy a comprehensive living experience.

Investing in such premium developments also offers potential for capital appreciation, especially given Abu Dhabi’s growing reputation as a hub for international investors and luxury living. Buyers looking for a blend of modern living and strategic investment should consider developments like mayyas at the bay.

Tips for First-Time Buyers

Buying property in Abu Dhabi for the first time can be daunting, but careful planning helps simplify the process:

- Research Thoroughly: Understand the market trends, pricing, and legal procedures before making decisions. Knowledge is a key advantage in negotiating deals.

- Work with Experts: Real estate consultants, legal advisors, and mortgage brokers can provide valuable guidance throughout the purchasing journey.

- Evaluate Total Costs: Consider not just the purchase price but also registration fees, service charges, and maintenance costs. A clear budget prevents surprises.

- Visit Properties: Whenever possible, inspect properties in person to evaluate the location, quality, and community amenities.

- Long-Term Planning: Consider your long-term goals, whether it’s rental income, personal use, or capital appreciation, to choose the property that aligns with your strategy.

Future Outlook for Abu Dhabi Real Estate

The Abu Dhabi real estate market in 2026 is expected to remain dynamic and attractive for buyers and investors. Key factors supporting this positive outlook include government-backed infrastructure projects, growing expatriate communities, and sustained interest in luxury and waterfront properties.

Emerging neighborhoods and mixed-use developments are likely to offer more affordable options while maintaining investment potential. At the same time, premium locations will continue to attract high-net-worth individuals seeking luxury living and lifestyle convenience.

Sustainable and smart developments are also gaining traction, with buyers placing increasing importance on energy efficiency, smart home features, and community planning. This trend is likely to shape property designs and amenities for the coming years.

Wrapping Up

Navigating the Abu Dhabi real estate market in 2026 requires careful planning, research, and awareness of current trends. Whether exploring properties for sale in abu dhabi or considering high-end projects like mayyas at the bay, buyers have a variety of options to match their lifestyle and investment goals. By understanding market dynamics, legal considerations, and financing options, property buyers can make informed decisions that maximize both satisfaction and long-term returns.

Abu Dhabi’s real estate market offers a unique blend of luxury, convenience, and strategic investment opportunities. With the right approach, buyers can secure properties that not only meet their immediate needs but also offer promising growth in value over time. 2026 is poised to be a year of opportunities, and staying informed is the key to capitalizing on them.