Life is unpredictable. Homeowners can suddenly face unexpected expenses such as urgent medical bills, emergency home repairs, or temporary income gaps. While credit cards or personal loans might come to mind, these options often carry high interest rates. An emergency home equity loan allows homeowners to access their home’s equity quickly, providing a safer and more manageable financial solution during critical times.

What Is an Emergency Home Equity Loan?

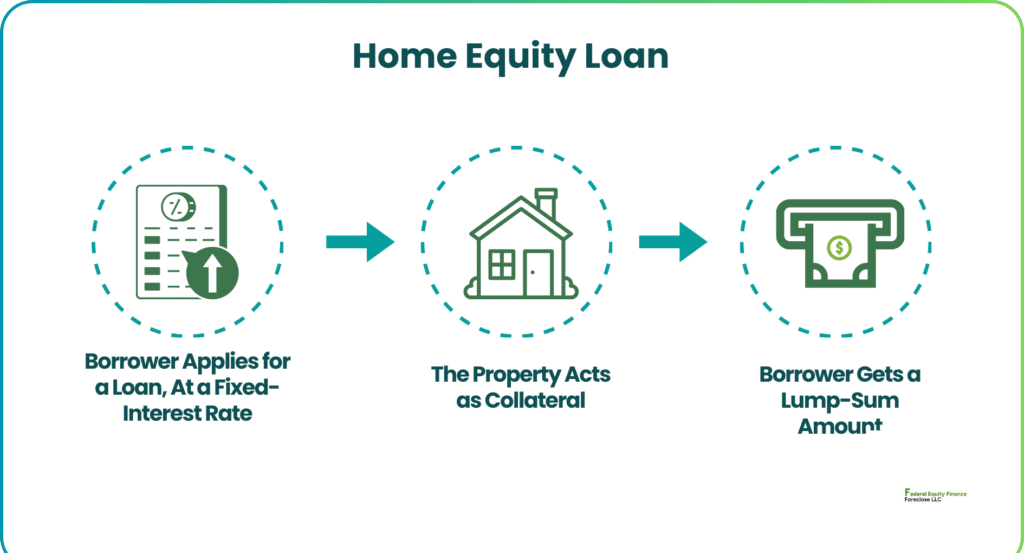

An emergency home equity loan is a secured loan that lets homeowners borrow a lump sum against the equity in their property. It is designed to address urgent financial needs and is repaid over a fixed term with predictable monthly payments.

Key points:

- Uses your home as collateral

- Fixed interest rate

- Lump-sum funding

- Designed for urgent expenses

How an Emergency Home Equity Loan Works

Here’s the typical process:

- Application and Pre-Approval: Submit basic financial and property information online or in person.

- Equity Assessment: The lender calculates how much of your home equity is available.

- Approval and Funding: Once approved, you receive a lump sum, often within days depending on documentation.

- Repayment: Monthly payments begin according to a fixed schedule.

Tip: Have your mortgage statements, income verification, and property details ready to speed up approval.

When to Consider an Emergency Home Equity Loan

This loan is best for urgent, unavoidable expenses where other financing options are costlier or impractical.

Common Use Cases:

- Emergency medical bills

- Urgent home repairs (e.g., roof, plumbing, HVAC)

- Covering unexpected tax obligations

- Preventing foreclosure due to short-term cash flow problems

From what I’ve seen, borrowers often choose emergency home equity loans over personal loans or high-interest credit cards because the interest is lower, and repayment is structured.

Emergency Home Equity Loan vs Personal Loan

Many homeowners wonder which option is better during a financial emergency.

Emergency Home Equity Loan

- Lower interest rates than unsecured loans

- Uses home as collateral

- Predictable monthly payments

Personal Loan

- Faster application, usually online

- Higher interest rates

- No collateral required

- Often smaller loan limits

My take: If you have sufficient equity, an emergency home equity loan is usually safer and more affordable in the long term.

Emergency Home Equity Loan vs HELOC

Some homeowners confuse these two options.

Home Equity Loan

- One-time lump sum

- Fixed interest rate

- Ideal for a single urgent expense

HELOC (Home Equity Line of Credit)

- Revolving credit line

- Variable interest rate

- Better for ongoing or multiple expenses

Here’s the thing… if you only need cash for one emergency, a home equity loan is simpler and easier to manage.

How Quickly Can You Access Funds?

Speed depends on preparation and the lender’s process.

Typical Timeline:

- Application: 1–2 days

- Documentation review: 3–7 days

- Appraisal: optional in some cases

- Funds disbursed: 2–5 days after approval

Pro tip: Lenders offering fast emergency home equity loan approval may still require verification and appraisal for larger amounts.

Costs and Interest Rates

Even during an emergency, it’s important to understand the costs:

- Interest Rate: Usually lower than credit cards, higher than first mortgages

- Origination Fee: Some lenders charge 1–3%

- Closing Costs: May apply, depending on loan amount

What most people miss: Comparing multiple lenders can save thousands in interest and fees, even in an urgent situation.

Risks to Consider

While an emergency home equity loan is convenient, it carries risks:

- Your home is collateral

- Missing payments could lead to foreclosure

- Closing costs increase the total loan cost

- Reduces equity for future financial needs

From experience, the risk is manageable if you borrow responsibly and have a repayment plan.

Common Mistakes Homeowners Make

- Borrowing more than necessary

- Not comparing lenders or interest rates

- Using equity for non-essential spending

- Ignoring total repayment costs

Here’s the thing… treating an emergency home equity loan like a short-term “free cash” option can create long-term financial strain.

FAQs: Emergency Home Equity Loan

1. Can I get a home equity loan for emergencies?

Yes. Licensed lenders often offer emergency home equity loans to cover urgent expenses.

2. How fast can funds be disbursed?

Typically, funds are available within 1–2 weeks depending on documentation and lender policies.

3. Is it better than a personal loan?

If you have enough equity, a home equity loan usually has lower interest and predictable payments.

4. Can I borrow with bad credit?

Approval is more challenging, but strong home equity and stable income may compensate for lower credit scores.

5. What emergencies are suitable for this loan?

Medical bills, urgent home repairs, and preventing foreclosure are common examples.

Final Thoughts

An emergency home equity loan is a practical financial tool for homeowners facing urgent cash needs. It’s not for discretionary spending, but when used responsibly, it can help avoid high-interest debt, cover critical expenses, and maintain financial stability.

The key is preparation: understand your home’s equity, compare lenders, and plan for repayment. That way, when an emergency hits, you’re not scrambling—you’re making informed choices that protect your home and your finances.