Stabilising underperforming assets is a strategic property management process designed to increase the net operating income and capital value of real estate through operational efficiencies and physical improvements. For property owners in the Sydney market, this involves identifying the specific causes of financial leakage—such as high vacancy rates or excessive maintenance costs—and implementing targeted recovery plans. By treating a property as a commercial business rather than a passive holding, investors ensure their portfolio remains resilient against market fluctuations and rising interest rates.

What Defines an Underperforming Asset?

An underperforming asset is any property that fails to meet its projected financial benchmarks, typically evidenced by stagnant rental growth or high tenant turnover. These properties often suffer from “deferred maintenance,” where small issues accumulate into 3 major problems: structural degradation, aesthetic irrelevance, and legal non-compliance. Identifying these indicators early prevents a minor cash flow dip from becoming a total portfolio liability.

| Indicator | Description | Impact on ROI |

| High Vacancy | Units remain empty for more than 21 days between tenancies. | Direct loss of monthly cash flow. |

| Negative Rent Gap | The current rent is 10% or more below the local market average. | Reduced capital valuation and borrowing power. |

| High Arrears | Tenants consistently pay more than 7 days late. | Disrupts mortgage repayments and budgeting. |

| Maintenance Ratio | Repair costs exceed 15% of the annual gross rental income. | Erodes the net profit margin of the asset. |

5 Steps to Stabilise a Property Portfolio

Stabilisation requires a 5-step framework that prioritises the most critical financial leaks before moving toward long-term value-add projects. Following this sequence ensures that capital is deployed where it generates the highest immediate return.

1. Perform a Comprehensive Operational Audit

An operational audit is the process of reviewing every contract, lease agreement, and utility bill associated with the property. To conduct an audit, you must examine the last 12 months of financial statements to identify 4 specific inefficiencies: overcharged strata fees, uncompetitive insurance premiums, redundant service contracts, and unpaid water consumption charges.

2. Implement Dynamic Rental Pricing

Dynamic pricing is a strategy that adjusts rent based on real-time supply and demand data rather than relying on 12-month-old appraisals. To stabilise income, owners must conduct weekly market scans of comparable properties in the immediate suburb. If a property sits vacant for more than 2 weeks, the price is adjusted by 2% to 3% to stimulate enquiry while maintaining the highest possible yield.

3. Resolve Deferred Maintenance

Deferred maintenance is the accumulation of necessary repairs that have been postponed, leading to a decrease in property appeal. To fix this, create a “priority list” of 5 essential upgrades, including:

- Safety Compliance: Updating smoke alarms, safety switches, and corded window coverings.

- First Impressions: Refreshing the “curb appeal” with low-maintenance landscaping and modern signage.

- Energy Efficiency: Installing LED lighting and water-saving tapware to reduce tenant utility costs.

- Interior Refresh: Replacing worn carpets with durable vinyl planks and applying a fresh coat of neutral paint.

- Structural Integrity: Addressing gutter leaks or roof pointing to prevent expensive internal water damage.

4. Improve Tenant Retention and Selection

Tenant retention is the practice of maintaining high-quality occupants through proactive communication and fair lease renewals. High turnover costs an owner 3 to 4 weeks of rent in “re-letting” fees and advertising expenses. Stabilisation involves vetting 100% of new applicants through comprehensive databases, including TICA and Equifax, to ensure a history of financial reliability.

5. Leverage Professional Management Oversight

Professional oversight is the delegation of daily operations to a dedicated firm that uses a “corporate real estate” mindset. While many owners attempt “self-management,” this often leads to missed rent reviews and overlooked compliance dates. For high-stakes assets, Revest Property Management provides the structured reporting and legal certainty required to transition an asset from a loss-making entity to a high-yield performer.

learn more: https://www.revestpg.com.au/

Target Audience and Situational Relevance

This guide is designed for 3 distinct groups of property owners who find themselves managing assets that are not meeting expectations.

- “Accidental” Landlords: Individuals who inherited a property or moved out of their home and have never managed a commercial asset before.

- Portfolio Builders: Investors who own 3 or more properties and find that the complexity of management is hindering their ability to acquire more.

- Distressed Asset Buyers: Strategic investors who intentionally purchase underperforming properties with the goal of “flipping” the management quality for a capital gain.

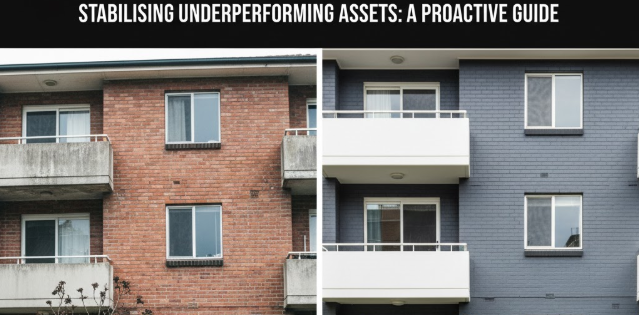

Use Case: The “Mid-Life” Apartment Block

In this scenario, a 1990s apartment block suffers from a 15% vacancy rate because the interiors look “dated” compared to new builds. Stabilisation involves a $5,000-per-unit “cosmetic uplift,” allowing the owner to raise the rent by $50 per week. The $2,600 annual increase per unit means the renovation pays for itself in under 24 months, while the capital value of the building increases by $50,000+ due to the higher yield.

Pros and Cons of Active Asset Stabilisation

Active management is a high-reward strategy, but it requires more engagement than the “set and forget” approach.

Pros:

- Immediate Equity Growth: Every $1 increase in weekly rent adds thousands to the property’s bank valuation based on current “cap rates.”

- Lower Stress: A stabilised property with a reliable tenant and updated systems requires fewer emergency phone calls and less crisis management.

- Tax Advantages: Most “value-add” improvements are depreciable items, providing 10s of thousands in tax offsets over the life of the investment.

Cons:

- Upfront Capital: Stabilisation often requires an initial injection of $2,000 to $10,000 to fix long-standing maintenance issues.

- Short-term Vacancy: You may need to ask a problematic tenant to vacate to perform renovations, resulting in a temporary loss of income.

The Science of Tenant Selection: Specificity Matters

Data shows that the “cost of a bad tenant” exceeds the cost of a vacant property. To avoid underperformance, professional managers use 3 specific metrics to vet applicants:

- Rent-to-Income Ratio: A tenant’s gross weekly income should be at least 3 times the weekly rent.

- Employment Stability: A minimum of 6 months in a current role or a 2-year history in the same industry.

- Rental Ledger Accuracy: Zero instances of “Non-Payment Notices” or “Breach Notices” in the last 2 tenancies.

Summary of the Proactive Approach

Stabilising an underperforming asset is not an overnight task; it is a 6-to-12-month commitment to excellence. By auditing expenses, investing in strategic maintenance, and ensuring legal compliance, you transform a risky liability into a resilient financial pillar. The difference between a “landlord” and a “property investor” is the willingness to treat real estate as an active business that requires constant refinement and professional expertise.